MEDICARE SUPPLEMENT PLANS (MEDIGAP) PLANS

Slide title

Write your caption hereButton

If you are on Medicare, you may not be aware that you have "gaps" in your coverage. Traditional Medicare only covers 80% of your medical expenses. You are responsible for the other 20%. To put that in perspective, if you had a heart attack and required open heart surgery, the cost would be about $100,000 or more. Your 20% out-of-pocket cost would be $20,000. This is where a Medicare Supplement plan could protect you. It covers the expenses that Medicare does not.

Unlike Medicare, Medicare Supplement insurance is not a federal program. It is offered by private health insurance companies that are strictly regulated by both the federal and state government. There are a few different levels of supplement plans available, and Insurance Plan Pros will help you determine which one will meet your needs based on the level of coverage you desire. Additionally, there are no networks with a Medicare Supplement plan. You can go to ANY DOCTOR or HOSPITAL, as long as they accept regular Medicare, even if you are traveling out of state.

At Insurance Plan Pros, we have extensive knowledge of the Medicare system, and we are happy to answer any questions you have about the different options that are available to you. We can evaluate your current coverage, identify any gaps you may have, and make an evaluation on what your best options might be. We are dedicated to helping you find the best coverage for your specific situation, while saving you money. Give us a call to schedule your free consultation at 469-340-3300

MEDICARE SUPPLEMENT INFORMATION:

What do I need to know about Medicare Supplement Insurance?

- You must have Medicare Part A and Part B.

- You will pay a Medicare Supplement company a monthly premium for your policy in addition to the monthly Part B premium you pay to Medicare.

- If you have not enrolled in Medicare Part B coverage yet, you can go to the following website, and create a profile to enroll: https://www.ssa.gov/benefits/medicare/

- You will also need to set up a separate Medicare Prescription Drug Plan and pay a separate premium for it. Go to the following website to enroll:

https://www.medicare.gov/plan-compare/

- A Medicare Supplement policy only covers one person. Spouses must buy a separate policy. (most companies offer a discount if you enroll together)

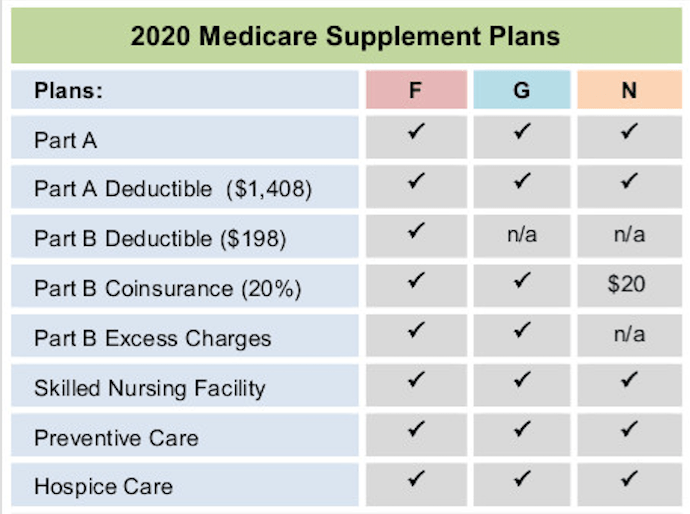

- All Medicare Supplement policies are required by law to have the exact coverage per Plan letter, which means for example that all Plan G plans have the exact same coverage, regardless of what company you purchase it from. Premiums however, can vary from company to company.

- Medicare Supplement plans do not cover dental, vision or hearing. They do cover the benefits listed in the chart to the right.

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

When can you purchase a Medicare Supplement Policy?

- The best time to buy a Medicare Supplement policy is during your "Open Enrollment" Period. This 6-month period begins on the first day of the month you turn 65 or older and enrolled in Medicare Part B.

- If you have coverage through an employer plan, and decide to keep it until you retire, you will have to enroll in Medicare Part B at that time, which will trigger your "Open Enrollment" period.

- During your "Open Enrollment" period there is no medical underwriting, meaning the company has to take you regardless of your health.

- For most people, your Medicare Part A coverage will start automatically when you turn 65.

- If you decide to purchase a Medicare Supplement plan outside your "Open Enrollment" period, you will be subject to medical underwriting and could be declined for coverage for certain serious medical conditions.

- You could be eligible for a "Special Enrollment" period of your current Medicare Advantage plan leaves Medicare, stops offering coverage in your area, or you move out of the area where your plan is located.

HOURS OF OPERATION

Mon - Fri : 9:00 am - 6:00 pm

Sat - Sun : Appointment Only

All Rights Reserved | Insurance Plan Pros